If you’ve got any money left over after you’ve paid for everything you have a ‘budget surplus’. Deduct the total amount you spend each month from your monthly income This will give you a clearer idea of your regular spending.

If you’re not sure what you’re spending your money on, try writing down everything you buy over a month.

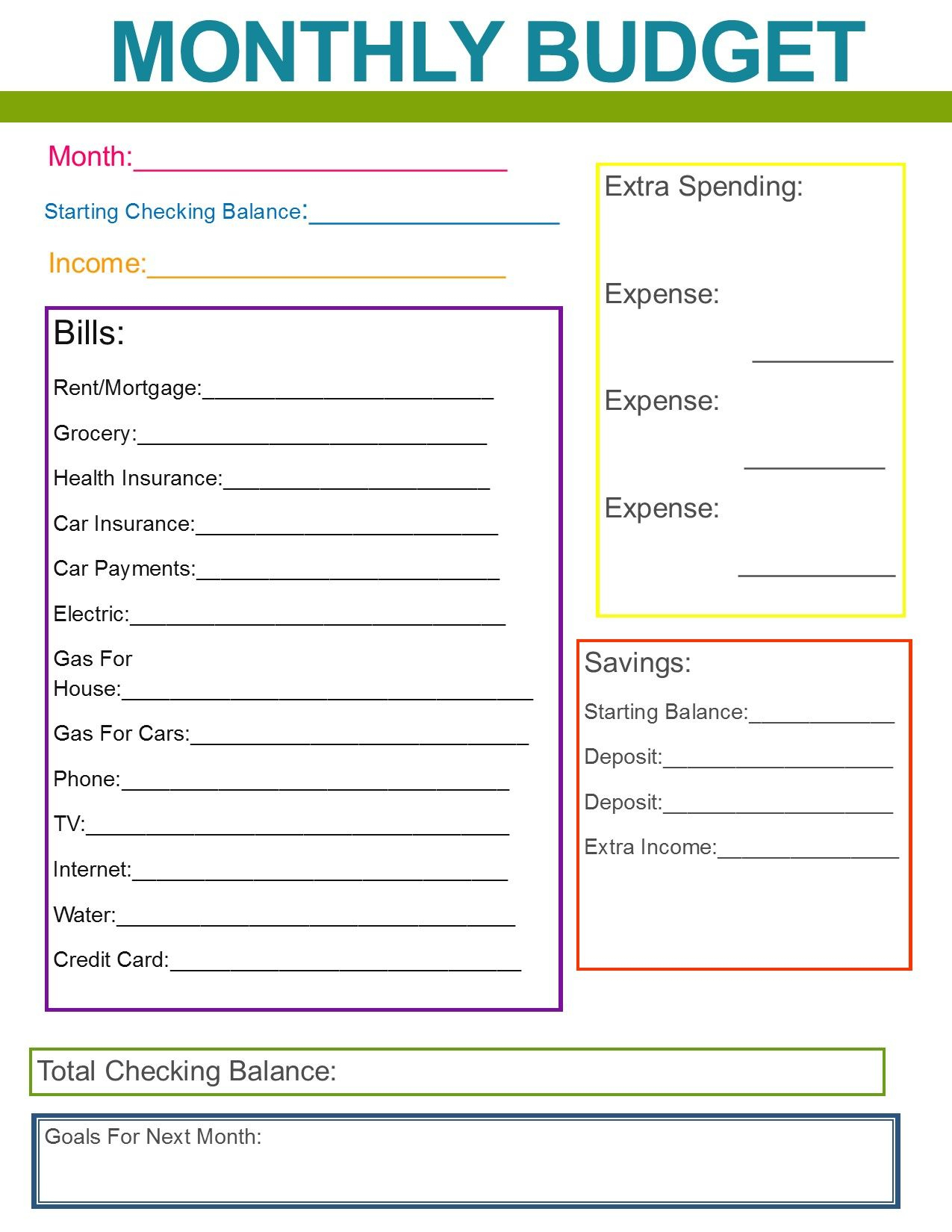

You can then set this money aside until the bill is due. To do this you need to divide the yearly cost by 12 to give you a monthly figure which you can include in your budget. You need to include amounts for things that you only pay for once a year or less often, such as Christmas, car repairs or vets bills. Shopping receipts can help you work out what you typically spend on these items each month. Next, write down what you usually spend on living costs such as food, clothing and toiletries. Find out more about what bills to pay first. These are classed as priorities, because they have the most severe consequences if your payment is late or if you miss a payment. Start with your most important bills, such as your mortgage, rent, council tax and utilities like gas, electricity and water. Make a list of everything you spend each month

#MONEY HELPER BUDGET PLANNER FREE#

A financial counsellor gives free advice and support to people who are going through financial hardship.įind a financial counsellor in your area on the National Debt Helpline website.Step 2. The National Debt Helpline offers free financial counselling. Knowing where every pound is being spent is a great first step to starting your savings, getting out of debt or preparing for retirement. They can also help you understand how tax, social security, wages and salary work together. FIS gives free and confidential education that can inform you and help you with decisions on your financial matters.įIS can support you with online information, tools and resources that can build your financial knowledge. You can talk to our Financial Information Service (FIS). You can call your regular payment line to find out if you're eligible. This means your Family Tax Benefit or Carer Allowance can be paid on a different week to your income support payment. To help you manage your money, you can ask for your Family Tax Benefit or Carer Allowance payment to be offset. This can help you if you find it hard to budget a fortnightly payment. The weekly payment option can allow you to get your income support payment weekly. Centrelink Deduction StatementsĬentrelink Deduction Statements help you track your deductions. It allows you to pay your state or territory housing authority rent through regular deductions from your Centrelink payments. Our Rent Deduction Scheme is a convenient, secure and free service. CentrepayĬentrepay is a free and voluntary service you can use to pay bills as regular deductions from your Centrelink payments. There are services to help you manage your money and set yourself up for success. A change in your income or expenses can affect your budget. Remember to review your budget often to make sure it’s still working for you.

That way you’ll know how much you need to save on a regular basis to reach your goals. You can then see if you have money left over. Use the simple money manager to do your budget. costs for annual and one-off expenses, like insurance and car registration.Calculate how much money you have coming in by using any of these:

0 kommentar(er)

0 kommentar(er)